#ppo insurance

Explore tagged Tumblr posts

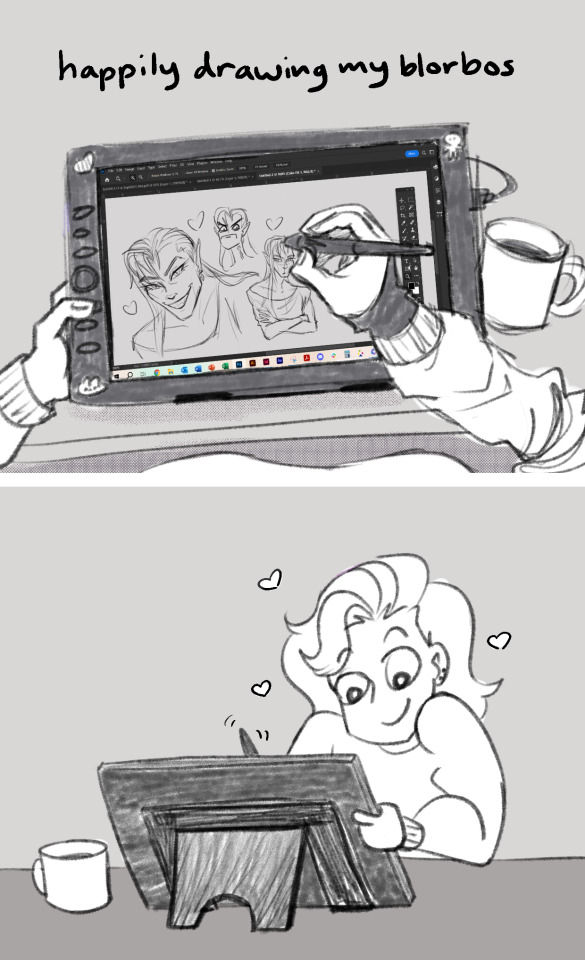

Text

i'd like to formally rescind my lifetime membership to Being An Adult, please

#the rush of fear I felt at 7pm tonight was fucking palpable#i just want to draw my silly little guys from my silly little shows#what do you mean i have to renew my auto insurance??#i don't want to know the difference between HMO and PPO#artist struggles#comics#comic#artists on tumblr

59 notes

·

View notes

Text

Montgomery County Chiropractic Center North Wales Pa 19454 #NorthWales In-Network chiropractor for Independence Blue Cross PPO and Personal Choice PPO health insurance plans IBX insurance #IndependenceBlueCross #PersonalChoicePPO #ibxinsiders

#chiropractic#chiropractor#montgomerycountychiropracticcenter#exercise#ergonomics#chiropractoradjustment#backpain#neckpain#nutrition#chiropractor in north wales pa#independence blue cross personal choice ppo health insurance#independence admnistrators insurance

7 notes

·

View notes

Text

trying to pick out a health insurance plan like

#atlas.txt#the ppo isnt with the insurer that i thought so it wouldnt cover my top surgery#ughfhfhfh#and i cant even ask my dad his advice REALLY bc im not out to him yet#FUCK

3 notes

·

View notes

Text

I work in a dental office. I have to call insurances and make sure the patient is covered and how much coverage they have… I hate it

#reblog#personal#honestly have not been feeling this job for a long while but I made it to the one year mark a few months ago which is good#but like I started this job with some burnout and then the burnout got worse and honestly I think I need at least a month long vacation#and like you’ll have insurances that supposedly cover pretty much everything… until it comes time to pay#they’re so damn cheap and like these are people’s lives you’re dealing with#or they take forever to approve a predetermination and then you lose a patient cuz they couldn’t wait any longer#oh and like I gotta get my own health insurance (job doesn’t offer)#and everything has gone up in price when I’m actually making less#AND I’M LOOKING AT HMOS WHICH SUCK BUT I CAN’T AFFORD A PPO#I hate it

142K notes

·

View notes

Text

Types of Health Insurance Plans (HMO, PPO, EPO, POS)

#insurance#types of health insurance#hmo insurance#health insurance ppo#hmo health insurance#medicare special needs plans#health insurance ppo plans#what is ppo insurance#types of medicare supplement plans#ppo medical insurance#insurance aims#insuranceaims

0 notes

Text

Comparing HMO, PPO, And EPO Plans In Group Health Insurance

In the landscape of group health insurance, employers often face a myriad of options to offer their employees. Among the most common types are Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Exclusive Provider Organization (EPO) plans. Each of these options has distinct features, advantages, and drawbacks, making it essential for employers to understand their differences to choose the right plan for their workforce.

Health Maintenance Organization (HMO)

HMO plans are characterized by their focus on providing coordinated and comprehensive care through a network of designated providers. Members must select a primary care physician (PCP) who serves as their main point of contact for medical care. Referrals from the PCP are generally required to see specialists.

Advantages:

Cost-Effective: HMO plans usually offer lower premiums and out-of-pocket costs compared to other plans, making them an attractive option for employers looking to minimize expenses.

Coordinated Care: The requirement for a PCP ensures that all healthcare services are well-coordinated, which can lead to improved health outcomes for members.

Preferred Provider Organization (PPO)

PPO plans offer more flexibility in choosing healthcare providers compared to HMO plans. Members can see any doctor or specialist without a referral, although they will pay less if they use providers within the PPO network.

Advantages:

Greater Flexibility: Members can access a broader range of providers, including specialists, without needing referrals. This is especially beneficial for those who require specialized care.

Out-of-Network Coverage: PPOs generally offer partial coverage for out-of-network services, allowing members to seek care from a wider array of providers.

Exclusive Provider Organization (EPO)

EPO plans share characteristics with both HMO and PPO models. Like HMOs, EPOs require members to use a specific network of providers for their healthcare services, but they also offer more flexibility than HMOs since they do not require referrals for specialist care.

Advantages:

No Referral Requirement: Members can see specialists without needing a referral, simplifying the process of accessing care.

Lower Premiums: EPO plans typically feature lower premiums than PPOs, making them cost-effective options for employers.

Conclusion

When selecting a group insurance plan, employers must consider the specific needs and preferences of their workforce. HMO plans are cost-effective and promote coordinated care, making them suitable for employees who prefer a structured approach to healthcare. PPO plans offer flexibility and wider provider access but come at a higher cost. EPO plans to strike a balance between the two, providing some flexibility without the need for referrals while still maintaining a limited provider network. By understanding the differences among these plan types, employers can make informed decisions that enhance employee satisfaction and health outcomes.

0 notes

Text

Choose the Perfect Health Plan | HMOs, PPOs, HDHPs

Understand health plans easily - HMOs save, PPOs give choices, HDHPs cost less. Find your fit. Your health, your plan. Ask us anything!

0 notes

Text

Choose the Perfect Health Plan | HMOs, PPOs, HDHPs

Understand health plans easily - HMOs save, PPOs give choices, HDHPs cost less. Find your fit. Your health, your plan. Ask us anything!

0 notes

Text

Flexible Transitional Health Coverage by Short-Term Insurance Plans

Discover the benefits of short-term health insurance plans offered by smart insurance agents. Our plans are designed to be flexible and cost-effective, catering to your changing lifestyle. Whether you're in between jobs or awaiting long-term coverage with essential benefits to ensure your protection, visit our website for more information.

#health insurance#affordable health insurance texas#company health care#hmo vs ppo#part d coverage#prescription drug coverage#affordable health insurance agency#smart life insurance agency

0 notes

Text

Montgomery County Chiropractic Center North Wales Pa 19454 #NorthWales In-Network chiropractor for Independence Blue Cross PPO and Personal Choice PPO health insurance plans IBX insurance #IndependenceBlueCross #PersonalChoicePPO #IBX

#chiropractic#chiropractor#montgomerycountychiropracticcenter#exercise#ergonomics#chiropractoradjustment#backpain#neckpain#nutrition#chiropractor in north wales pa#independence blue cross personal choice ppo health insurance

4 notes

·

View notes

Text

Sorry, 'urgent' cases for UHC take up to three days.... Then your request is denied. Then your appeal is denied. Then your P2P is denied. Then it's approved, but then your claim is denied because they cant find proof of the approval, your reference number doesn't exist.

Love how they keep calling it an "urgent" manhunt to find the guy that shot the United Healthcare CEO

Like brother, there is almost nobody that wants that guy caught

#i am so TIRED of INSURANCES#i had to sit on the phone with bcbs for three hours just to be hung up on last week#fucking KAISER PPO and their FUCKING FAX FORMS#cigna????? open your fucking portals back up?!?!?!??!#also screw evicore#screw availity#carelon for gastro youre the love of my life#screw fucking PREDICTAL#care coordinators by quantum is a good portal too but that doesnt matter here#ALSO. COVERMYMEDS. FUCK YOU GUYS TOO.

2K notes

·

View notes

Text

Insurance: Details about Marketplace plans that were available to me

Based on notes I took while deciding on my new insurance plan, here are some limited details about Marketplace plans that were available to me in the state of Michigan. You may or may not have the same plans available.

Blue Cross Blue Shield PPO

-- Purchase decision: ✅ -- Certificate of Coverage published: ✅ -- -- No stated "one per lifetime" limitation on sterilization: ✅ -- -- Coverage for treatment of complications related to non-covered services: Doesn't exclude coverage: ✅ -- No referral to see specialist: ✅ -- Key providers and facilities in-network: ✅ -- Available plans: Secure, Extra, HSA -- Reject reason: None

Blue Care Network HMO

-- Purchase decision: ❌ -- Certificate of Coverage published: ✅ -- -- No stated "one per lifetime" limitation on sterilization: ✅ -- -- Coverage for treatment of complications related to non-covered services: Doesn't exclude coverage: ✅ -- No referral to see specialist: ❌ -- Key providers and facilities in-network: ✅ -- Available plans: Select, Preferred, Local, Metro Detroit; some of these weren't available in my region -- Reject reason: Need referral to see specialist

UnitedHealthcare HMO

-- Purchase decision: ❌ -- Certificate of Coverage published: ✅ -- -- No stated "one per lifetime" limitation on sterilization: ✅ -- -- Coverage for treatment of complications related to non-covered services: Explicitly includes coverage: ✅✅ -- No referral to see specialist: ❌ -- Key providers and facilities in-network: ❌ -- Reject reason: Need referral to see specialist; Key providers and facilities out-of-network, with smaller network overall

Molina Marketplace HMO

-- Purchase decision: ❌ -- Certificate of Coverage published: ✅ -- -- No stated "one per lifetime" limitation on sterilization: ✅ -- -- Coverage for treatment of complications related to non-covered services: Explicitly includes coverage: ✅✅ -- No referral to see specialist: ✅ -- Key providers and facilities in-network: ❌ -- Reject reason: Key providers and facilities out-of-network

MyPriority Health HMO

-- Purchase decision: ❌ -- Certificate of Coverage published: ❌ -- No referral to see specialist: ✅ -- Key providers and facilities in-network: ✅ -- Reject reason: Certificate of Coverage not published

McLaren HMO

-- Purchase decision: ❌ -- Certificate of Coverage published: ❌ -- No referral to see specialist: ✅ -- Key providers and facilities in-network: ✅ -- Reject reason: Certificate of Coverage not published

#insurance::marketplace#insurance::certificate#insurance::network#insurance::hmo-ppo#insurance::marketplace::bcbs#insurance::marketplace::bcn#insurance::marketplace::uhc#insurance::marketplace::molina#insurance::marketplace::mypriority#insurance::marketplace::mclaren#strategy::sterilization#strategy::self-pay

0 notes

Text

ough the pain of finally getting around to calling a dentist and then waffling on the phone for half an hour bc you forgot they needed insurance info and the online portal/digital card for your dental insurance sucks shit for finding information

#kcat talks#im trying so hard my card doesnt say hdmo or ppo or anything i had to look up the plan name#also they asked who the insurance is from like employer and so i told them my employer's name and they were like 'is that what it says on t#the card' and i was like 🥺 my card doesn't say shit idk!!!#update: ofc it doesnt have my group number either and i had to dig through previous eobs + ping hr to ask about it fhskfh

0 notes

Text

Types of Health Plans

This post is going to suck to read. I know it will, because it sucks to write it because it’s boring.

Time to put on your big kid pants, because it’s important.

Let’s talk about the three major types of plans and three major types of healthcare accounts, and the talking points of each.

Preferred Provider Organization (PPO) - A general health insurance plan, and (in my experience) the most common. You can go wherever you want for healthcare, but you’ll pay less if you stay within the preferred provider list (a fancy way of saying in-network providers). You don’t need a PCP to refer you to a specialist.

Exclusive Provider Organization (EPO) - You only have coverage for in-network providers. You have no out-of-network coverage, except for emergencies. You don’t need a PCP to refer you to a specialist.

Health Maintenance Organization (HMO) - A very specific insurance policy that covers only certain healthcare provider systems (think hospital systems across a large metroplex). It is usually cheaper, but your choice is significantly more limited. You will need a PCP to refer you to a specialist, and you’ll need special permission from your insurance for an out-of-network provider to be covered.

Fun, right? Not confusing at all. It gets better! There are also healthcare accounts that your policies can offer. Let’s talk more about them.

Health Savings Account (HSA) - Pre-taxed money lets you pay for medical expenses (that qualify). You can invest money into the HSA and it rolls over every year to any employer. Basically, the funds never go away—new employer, new policy, and retirement don’t affect your HSA. This is usually associated with a high deductible, lower premium plan.

Flexible Spending Account (FSA) - This is associated with more traditional health plans. It’s also pre-taxed money, but it expires at the end of the year. Both you and your employer contribute to the fund, but anything you don’t use goes back to the employer, not you. The money doesn’t roll over each year or accumulate between employers. There are FSA plans all over the map in terms of deductibles/premiums, so it’s hard to generalize which one it’s associated with the most.

Health Reimbursement Account (HRA) - I’m going to be honest, I don’t know as much about this one because I personally haven’t worked with one. From what I know, it’s an employer-owned and funded account to help members bridge the gap on their health insurance. You can usually use it to pay copays, deductibles, and coinsurance. This doesn’t roll over and you don’t carry it with you, but your employer is the only one who pays into it.

Confused? Yep.

So how do you pick one? Well. I can't tell you, because it's up to you. But in my opinion...

I have a lot of health problems, so I want the largest network possible. I don't want to try to make a PCP appointment every time I need to see my specialist(s). I'm young and I don't plan on staying at the same employer forever. I'd pick a PPO HSA plan, because of the flexibility of the provider network and the rollover of the account. This will probably be a more expensive premium each month, but for me, it's worth it.

Maybe you're in excellent health. You've worked at your company for decades and have no plans of leaving, and you go to your annual check-up and that's it. Great! Maybe you are fine with an EPO or HMO plan and an FSA. Those could be cheaper premiums.

It's up to you. It depends on your needs and your spending preferences.

#health insurance struggles#health insurance#healthcare#health care#medical#medicine#insurance#medical care#ppo#hmo#epo#hsa#fsa#hra#healthcare spending accounts#healthcare accounts

0 notes

Note

hello! i display a lot of the symptoms of having trisomy x and would like to find out for sure if i'm intersex or not, but afaik the only way to know for sure is to get a karyotype and i'm terrified of the medical discrimination i might face as a result of doctors knowing i'm intersex. is there any other way for me to find out but still have my doctor not know? or am i just overreacting (especially since most other intersex people don't get the choice of finding out or not)?

Hi anon!

I think it's totally understandable that you have a lot of fear about trying to navigate the medical system as a potentially intersex person. It can be really difficult to have to deal with the amount of discrimination we face when we're seeking a diagnosis and existing as an intersex person in the medical system. It's fucked up that we have to think through all these things when we're seeking care, instead of just being able to trust that we would receive compassionate and respectful care that honored our autonomy.

Unfortunately, I don't think there is any way for you to confirm a Trisomy X diagnosis without getting a karyotype/chromosomal microarray, just because there really is no other way to confirm what chromosomes you have. However, I think there are some ways that you could navigate it that might make it a little easier to avoid some kinds of discrimination.

This information is all based on the US healthcare and insurance system because that's what I have direct experience with, but feel free to send another ask if you live somewhere else and we can brainstorm some ideas for your health system.

My first thought is that if you want a diagnosis but don't want to impact the rest of the medical care you receive, you might be able to see a separate genetic counselor that's not linked to the rest of your medical record and medical care. There are a lot of services that do telehealth genetic counseling such as Genome Medical, and if they take your insurance, you might be able to get testing set up through them but not have it show up on the rest of your medical record. The nice thing about this is that you only have to deal with the telehealth clinician a few times and then get to choose whether or not you want to disclose this information to any future providers you see, and you don't need to have this information in your medical record if you don't want to.

If that's not an option but you have a PPO or POS health insurance plan where you can see any preferred network providers without referrals, you might be able to go to a separate genetic counselor that is part of a different hospital or clinic than where you normally receive care.

If your health insurance is an HMO plan where you have to get PCP referrals and can only see in network providers, that might make it difficult to seek care that isn't linked to your medical record. If this is the case but you're still interested in seeking a diagnosis, it might be worth brainstorming some things that would make you feel safer through the process. This could look like bringing another supportive person with you who could help advocate for you, preparing scripts for how you want to advocate for yourself, seeking out information about your rights as a patient, asking other intersex people for doctor recommendations, bringing in the "What we wish our doctors knew" brochure from InterACT. I won't lie, having an intersex variation on your medical record can make seeking medical care more complicated, but I think it can be slightly easier to navigate when you're a teen or adult who has more autonomy over their care, can consent to things, switch providers more easily, and has more of a say in their care.

If any followers have any other innovative ideas about how to seek diagnosis, feel free to add on.

Ultimately, the choice about whether to seek a diagnosis or not is always up to you. You're the expert on your own experience and know what would feel right for you at this point in your life. I don't think you're overreacting or being silly, and I wish things were different and it was easier for you to seek a diagnosis.

Truly wishing you the best of luck, anon.

11 notes

·

View notes

Note

i know u said u don't have insurance, but have u considered just buying your own insurance? surely that will be less than 23k (i imagine it will be roughly 700 per month). u could even get on a PPO plan from a state with good medical coverage like Massachusetts (blue cross). even the out of network out-of-pocket maximum will be way less than 23k minus the annual cost of coverage.

okay, so the plan is: buy my own insurance (easy) (will be done quickly) (easy), find a hospital/specialist that takes said insurance (easy) (the places covered by insurance will definitely give me good results) (having my choices narrowed down won't sacrifice quality), or check the surgeons I've rustled up myself (the insurance will def cover). then I'll get the reduction (this will be quick) (there will be no hoops to jump through) (I will not have to explore "other options" for a number of months / up to a couple years to assure I've ruled out other means of pain management) (I won't have to do a ~year of physio) (I will qualify) (I won't have to wait a long time) (I will not have to be a certain BMI) and get the amount of tissue/weight removed that I've been wanting (the coverage won't specify the amount I'm to have removed), and bing bang boom, my life is fixed

80 notes

·

View notes